Can I survive without tech for three days?

What is it like to fast for three days without any technology or devices? CNBC.com’s Uptin Saiidi took on the challenge, as he goes on a quest to learn more about tech addiction and the billion dollar mindfulness industry hoping to combat it. CNBC International video above published May 15, 2019.

Domain referenced: headspace.com

Tweets by Headspace

Showing posts with label tech. Show all posts

Showing posts with label tech. Show all posts

2019-07-03

2019-06-27

Jumia $JMIA Beating Amazon $AMZN & Alibaba $BABA In Africa (video)

Why Jumia Is Beating Amazon And Alibaba In Africa

Jumia has been dubbed the "Amazon of Africa" as Africa's largest e-commerce operator, surpassing Amazon and China's Alibaba, and it's the first African tech start-up to go public on the New York Stock Exchange. Investors had high hopes for Jumia when it went public on April 12. Now, Jumia is adjusting to its new international status, and figuring out what that status means for the African continent.

Sacha Poignonnec and Jeremy Hodara, former McKinsey & Company employees, founded the company in 2012. Like Amazon and Alibaba, Jumia allows customers to buy products like cell phones, shoes, and groceries online. Jumia also offers bill paying, food delivery, and cellular data plans.

China Daily, a Chinese state-run news organization, says that Alibaba serviced 4.2 million African customers through its AliExpress services since it entered the continent.

Jumia serviced 4.3 million users and 81,000 active sellers in 14 countries. Amazon is available in 11 countries on the African continent, but neither Amazon nor Alibaba have had the benefit of getting their start in African countries. Jumia, for example, offers unique features like allowing customers to pay for items upon delivery. CNBC video above published Jun 25, 2019.

Jumia is an e-commerce platform for electronics, fashion, and more. It has partnered with more than 81,000 local African companies and individuals and is a direct competitor to Kilimall in Kenya and Konga in Nigeria. Started in 2012 in Lagos, the company currently has a presence across 12 African countries.

Jumia Technologies AG

Jumia has been dubbed the "Amazon of Africa" as Africa's largest e-commerce operator, surpassing Amazon and China's Alibaba, and it's the first African tech start-up to go public on the New York Stock Exchange. Investors had high hopes for Jumia when it went public on April 12. Now, Jumia is adjusting to its new international status, and figuring out what that status means for the African continent.

Sacha Poignonnec and Jeremy Hodara, former McKinsey & Company employees, founded the company in 2012. Like Amazon and Alibaba, Jumia allows customers to buy products like cell phones, shoes, and groceries online. Jumia also offers bill paying, food delivery, and cellular data plans.

China Daily, a Chinese state-run news organization, says that Alibaba serviced 4.2 million African customers through its AliExpress services since it entered the continent.

Jumia serviced 4.3 million users and 81,000 active sellers in 14 countries. Amazon is available in 11 countries on the African continent, but neither Amazon nor Alibaba have had the benefit of getting their start in African countries. Jumia, for example, offers unique features like allowing customers to pay for items upon delivery. CNBC video above published Jun 25, 2019.

Jumia is an e-commerce platform for electronics, fashion, and more. It has partnered with more than 81,000 local African companies and individuals and is a direct competitor to Kilimall in Kenya and Konga in Nigeria. Started in 2012 in Lagos, the company currently has a presence across 12 African countries.

Jumia Technologies AG

- Domain: jumia.com / group.jumia.com

- Founded: Nigeria

- Traded as: NYSE: JMIA

- Founders: Sacha Poignonnec, Raphael Kofi Afaedor, Tunde Kehinde

- CEO: Sacha Poignonnec (2012–), Jeremy Hodara (2012–)

- Parent organization: Rocket Internet

2019-05-29

How Corning $GLW Created Gorilla Glass And Reinvented Itself (video)

How Corning Created Gorilla Glass And Reinvented Itself

Since 1851, Corning has evolved from a light bulb manufacturer to Pyrex creator to making high-tech glass products for companies like Apple, Google, Verizon and Samsung. Here is a look at how Corning has continuously reinvented itself to keep up with the changing times. CNBC.com video above published April 25, 2019.

Domain: corning.com

NYSE: GLW:

Tweets by corninggorilla

Since 1851, Corning has evolved from a light bulb manufacturer to Pyrex creator to making high-tech glass products for companies like Apple, Google, Verizon and Samsung. Here is a look at how Corning has continuously reinvented itself to keep up with the changing times. CNBC.com video above published April 25, 2019.

Domain: corning.com

NYSE: GLW:

|

| $GLW |

2019-05-22

Interview | Ruth Porat, CFO at Alphabet and Google $GOOG $GOOGL

Ruth Porat, CFO at Alphabet and Google

“You’re at the table because people want your voice. It’s easy to forget that. Don’t keep second guessing. If you have a point of view, the reason you were hired is because people want to hear it.”

Ruth Porat, CFO at Alphabet and Google, was interviewed for the final View from the Top for this academic year at the Stanford Graduate School of Business. Failing to invest for the long term could be one of tech’s greatest vulnerabilities, she said, and advised students to keep thinking about investing for the long haul.

”What I’ve seen is that if you don’t invest in the long term, you’re sowing the seeds of your own destruction.” In the video, Porat discusses her experiences while at Morgan Stanley $MS (morganstanley.com) and later, Google $GOOGL, $GOOG (google.com). Stanford Graduate School of Business video above published May 21, 2019.

NYSE: MS

NASDAQ: GOOGL

Tweets by MorganStanley

“You’re at the table because people want your voice. It’s easy to forget that. Don’t keep second guessing. If you have a point of view, the reason you were hired is because people want to hear it.”

Ruth Porat, CFO at Alphabet and Google, was interviewed for the final View from the Top for this academic year at the Stanford Graduate School of Business. Failing to invest for the long term could be one of tech’s greatest vulnerabilities, she said, and advised students to keep thinking about investing for the long haul.

”What I’ve seen is that if you don’t invest in the long term, you’re sowing the seeds of your own destruction.” In the video, Porat discusses her experiences while at Morgan Stanley $MS (morganstanley.com) and later, Google $GOOGL, $GOOG (google.com). Stanford Graduate School of Business video above published May 21, 2019.

NYSE: MS

|

| $MS |

|

| $GOOGL |

2019-05-06

Tech Unicorn IPOs, Uber $UBER, Month of May Preview Video

Tech Unicorn IPOs, Monthly Preview

In this preview video, The Banker's capital markets editor Kat Van Hoof talks to Joy Macknight about the appeal of big tech listings for investors, despite some major red flags. TheBanker.com video above published Apr 30, 2019.

YouTube Transcript (edited for correctness by DomainMondo.com)

00:00 [Music]

00:06 hello and welcome to the preview of the

00:09 May issue of the banker I enjoy McKnight

00:11 managing editor and I'm joined by Kat

00:14 van hoof Investment Banking and capital

00:16 markets editor this month's cover story

00:18 takes a closer look at the big tech

00:20 unicorn listings taking the market by

00:22 storm cat thanks so much for joining us

00:24 today so tell me a little bit about

00:27 what's happening we have recently lyft,

00:30 pinterest, slack have gone to the

00:33 market with their initial public

00:34 offerings and uber is also coming to

00:36 market why are they all coming to market

00:39 now well as usual it's a bit of a

00:40 confluence of different things so these

00:43 companies have been in the market have

00:45 actually been around for quite a long

00:46 time now we we use these apps every day

00:48 and they've done really large private

00:51 funding rounds so they've gotten to a

00:52 stage in the life cycle where an exit is

00:55 sort of the next logical and sometimes

00:57 only step because they're too big for

00:59 another round but there's also a little

01:00 bit of a function of the market where

01:02 things are still a bit benign monetary

01:05 policy is still very supportive but

01:07 maybe a year or two down the line things

01:09 starting to look a bit more shaky and so

01:12 if you want to do a bit more of a risky

01:14 IPO for a high-growth public offering

01:18 like this now is probably a good time to

01:21 be to be looking at this rather than a

01:23 little bit further down the line okay

01:25 but lyft was the first one to go and it

01:27 hasn't done that well in the after

01:29 markets you know what does what does

01:31 that signal for the ones coming through

01:33 so normally when you have a couple of

01:36 IPOs in the same sector and one of them

01:38 goes first and doesn't do very well it

01:40 usually puts a bit of a damper on the

01:42 rest of the listings down the line well

01:44 we in this case it wasn't quite so

01:46 straightforward lyft and do very well it

01:49 popped on the first day it listed a

01:52 little bit above its initial price range

01:53 and then popped on the first couple of

01:55 days but sort of since then hasn't been

01:57 doing very well but then Pinterest

01:58 listed a couple of weeks later and has

02:02 been doing a little bit better so

02:03 normally I would say well it's not a

02:06 good signal especially for uber which is

02:08 in the same sector it's also a right

02:10 ailing company but it's hard to tell

02:12 because sometimes they can

02:13 the case that investors just don't

02:15 really like lift but might like uber but

02:17 it or it can be a bigger signal of them

02:19 not really feeling all that confident

02:21 about this type of IPO and there are a

02:24 few questions about sort of the

02:26 sustainability of their business models

02:28 which are definitely making things a bit

02:29 harder for these IPOs well that is a big

02:31 problem isn't it because none of these

02:33 companies are really profitable and the

02:35 big sense you know what what challenges

02:38 that does that pose in investors in

02:41 these companies so the profitability is

02:43 a big thing and usually if a company has

02:47 a lot of structural growth investors are

02:49 happy to overlook a lack of

02:51 profitability but there are a lot of

02:53 questions being asked you know these

02:54 companies aren't like Google that listed

02:56 very early on in their lifecycle they

02:59 are listening as more mature companies

03:00 and still haven't quite gotten over that

03:03 profitability hurdle there's a lot of

03:05 questions being asked about the revenues

03:07 growing exponentially but also the loss

03:10 is deepening because the costs are still

03:11 very high there's a lot of money being

03:14 thrown at sales and marketing so long as

03:16 there's growth I think investors will be

03:18 happy with it but once you list that

03:20 pressure to turn that profit is going to

03:23 be definitely doubling down for these

03:26 companies so alongside a few other red

03:30 flags this is definitely one of the

03:31 major concerns

03:32 well another red flag is really around

03:34 governments you know how much is that

03:36 making an impact on how successful these

03:38 IPOs will be yeah governance is a

03:40 massive theme in investment and it's

03:43 only going to get bigger it's only you

03:44 know it's a one-way street it's not

03:46 coming back by its nature there's a lot

03:48 of key man risk you take you man because

03:50 they know there's a lot of a CEOs tend

03:52 to be men but there's a lot of key man

03:54 riskier by its nature where it's run by

03:58 a very charismatic of an entrepreneur a

04:00 set of entrepreneurs and while that is

04:03 great to get VC in a venture capital

04:05 funding private funding it might not be

04:07 sometimes have this great personality

04:09 cult it might not be the right thing for

04:11 a big listed company to have a sort of

04:13 combative or sometimes abrasive manner

04:17 and then on the other hand a lot of

04:18 these companies lyft for instance our

04:20 listing with dual class shares which

04:22 means that they they are selling shares

04:25 but not the equal amount of voting

04:27 right so the entrepreneurs retain a lot

04:29 of the control this can be helpful

04:31 because sometimes investors Cheryl

04:33 doesn't always understand the companies

04:35 as well but also it poses a great risk

04:37 in case something goes wrong

04:39 stockholders have a lot fewer tools at their

04:41 disposal to call the entrepreneurs to

04:43 account essentially excellent well thank

04:45 you so much for your insights to get a

04:47 copy of the May issue of The Banker

04:48 please go to thebanker.com.

feedback & comments via twitter @DomainMondo

In this preview video, The Banker's capital markets editor Kat Van Hoof talks to Joy Macknight about the appeal of big tech listings for investors, despite some major red flags. TheBanker.com video above published Apr 30, 2019.

Editor's note: Uber (NYSE: UBER) (uber.com) is expected to start trading this week, Thursday or Friday, May 10, 2019. With pricing in the range of $44 to $50 a share, the company is setting a valuation range of $80B to $91B vs. initial expectations for $100B or more. Uber's operating loss of $3B last year on $11.3B in revenue and negative free cash flow of $2.1B, have not deterred investors who usually cite Uber's scale and market-leading ridehailing position, its fast growing UberEats (ubereats.com), and a promising freight brokerage (uberfreight.com) business.See also on Domain Mondo:

And elsewhere:

- SEC Edgar search results for Uber Technologies, Inc.

- What Uber Left Behind in Asia--Emerging markets outshine the U.S. in ride-hailing, as the burgeoning success of Go-Jek and Grab shows--bloomberg.com.

- Lyft First Quarter (Q1) 2019 Earnings LIVE Webcast, Tuesday, May 7, 2019, 5pm EDT

YouTube Transcript (edited for correctness by DomainMondo.com)

00:00 [Music]

00:06 hello and welcome to the preview of the

00:09 May issue of the banker I enjoy McKnight

00:11 managing editor and I'm joined by Kat

00:14 van hoof Investment Banking and capital

00:16 markets editor this month's cover story

00:18 takes a closer look at the big tech

00:20 unicorn listings taking the market by

00:22 storm cat thanks so much for joining us

00:24 today so tell me a little bit about

00:27 what's happening we have recently lyft,

00:30 pinterest, slack have gone to the

00:33 market with their initial public

00:34 offerings and uber is also coming to

00:36 market why are they all coming to market

00:39 now well as usual it's a bit of a

00:40 confluence of different things so these

00:43 companies have been in the market have

00:45 actually been around for quite a long

00:46 time now we we use these apps every day

00:48 and they've done really large private

00:51 funding rounds so they've gotten to a

00:52 stage in the life cycle where an exit is

00:55 sort of the next logical and sometimes

00:57 only step because they're too big for

00:59 another round but there's also a little

01:00 bit of a function of the market where

01:02 things are still a bit benign monetary

01:05 policy is still very supportive but

01:07 maybe a year or two down the line things

01:09 starting to look a bit more shaky and so

01:12 if you want to do a bit more of a risky

01:14 IPO for a high-growth public offering

01:18 like this now is probably a good time to

01:21 be to be looking at this rather than a

01:23 little bit further down the line okay

01:25 but lyft was the first one to go and it

01:27 hasn't done that well in the after

01:29 markets you know what does what does

01:31 that signal for the ones coming through

01:33 so normally when you have a couple of

01:36 IPOs in the same sector and one of them

01:38 goes first and doesn't do very well it

01:40 usually puts a bit of a damper on the

01:42 rest of the listings down the line well

01:44 we in this case it wasn't quite so

01:46 straightforward lyft and do very well it

01:49 popped on the first day it listed a

01:52 little bit above its initial price range

01:53 and then popped on the first couple of

01:55 days but sort of since then hasn't been

01:57 doing very well but then Pinterest

01:58 listed a couple of weeks later and has

02:02 been doing a little bit better so

02:03 normally I would say well it's not a

02:06 good signal especially for uber which is

02:08 in the same sector it's also a right

02:10 ailing company but it's hard to tell

02:12 because sometimes they can

02:13 the case that investors just don't

02:15 really like lift but might like uber but

02:17 it or it can be a bigger signal of them

02:19 not really feeling all that confident

02:21 about this type of IPO and there are a

02:24 few questions about sort of the

02:26 sustainability of their business models

02:28 which are definitely making things a bit

02:29 harder for these IPOs well that is a big

02:31 problem isn't it because none of these

02:33 companies are really profitable and the

02:35 big sense you know what what challenges

02:38 that does that pose in investors in

02:41 these companies so the profitability is

02:43 a big thing and usually if a company has

02:47 a lot of structural growth investors are

02:49 happy to overlook a lack of

02:51 profitability but there are a lot of

02:53 questions being asked you know these

02:54 companies aren't like Google that listed

02:56 very early on in their lifecycle they

02:59 are listening as more mature companies

03:00 and still haven't quite gotten over that

03:03 profitability hurdle there's a lot of

03:05 questions being asked about the revenues

03:07 growing exponentially but also the loss

03:10 is deepening because the costs are still

03:11 very high there's a lot of money being

03:14 thrown at sales and marketing so long as

03:16 there's growth I think investors will be

03:18 happy with it but once you list that

03:20 pressure to turn that profit is going to

03:23 be definitely doubling down for these

03:26 companies so alongside a few other red

03:30 flags this is definitely one of the

03:31 major concerns

03:32 well another red flag is really around

03:34 governments you know how much is that

03:36 making an impact on how successful these

03:38 IPOs will be yeah governance is a

03:40 massive theme in investment and it's

03:43 only going to get bigger it's only you

03:44 know it's a one-way street it's not

03:46 coming back by its nature there's a lot

03:48 of key man risk you take you man because

03:50 they know there's a lot of a CEOs tend

03:52 to be men but there's a lot of key man

03:54 riskier by its nature where it's run by

03:58 a very charismatic of an entrepreneur a

04:00 set of entrepreneurs and while that is

04:03 great to get VC in a venture capital

04:05 funding private funding it might not be

04:07 sometimes have this great personality

04:09 cult it might not be the right thing for

04:11 a big listed company to have a sort of

04:13 combative or sometimes abrasive manner

04:17 and then on the other hand a lot of

04:18 these companies lyft for instance our

04:20 listing with dual class shares which

04:22 means that they they are selling shares

04:25 but not the equal amount of voting

04:27 right so the entrepreneurs retain a lot

04:29 of the control this can be helpful

04:31 because sometimes investors Cheryl

04:33 doesn't always understand the companies

04:35 as well but also it poses a great risk

04:37 in case something goes wrong

04:39 stockholders have a lot fewer tools at their

04:41 disposal to call the entrepreneurs to

04:43 account essentially excellent well thank

04:45 you so much for your insights to get a

04:47 copy of the May issue of The Banker

04:48 please go to thebanker.com.

feedback & comments via twitter @DomainMondo

2019-03-26

Retailers Tracking Customers' Movements, Future of Retail? (video)

Stores are starting to track your every move

Location-based apps are helping retailers track movement of its customers. CNBC's Uptin Saiidi explores how the future of retail is being shaped in China. CNBC International video above published on Mar 7, 2019.

Tracking takes place through apps for which users have enabled location services (e.g., weather, mapping, or ride-sharing apps). Seven apps have location tracking enabled on an average smartphone in China, according to Cosmose.

Cosmose, a retail tech start-up, connects anonymous movements of more than 1 billion smartphones in Asia to retailers like L’Oreal, Burberry and Budweiser.

Domain: cosmose.co

Tweets by Cosmose_

Location-based apps are helping retailers track movement of its customers. CNBC's Uptin Saiidi explores how the future of retail is being shaped in China. CNBC International video above published on Mar 7, 2019.

Tracking takes place through apps for which users have enabled location services (e.g., weather, mapping, or ride-sharing apps). Seven apps have location tracking enabled on an average smartphone in China, according to Cosmose.

Cosmose, a retail tech start-up, connects anonymous movements of more than 1 billion smartphones in Asia to retailers like L’Oreal, Burberry and Budweiser.

Domain: cosmose.co

Tweets by Cosmose_

2019-01-28

Codam Is A New Way To Train Tech Professionals (video)

Codam: a new way to train much-needed tech professionals

No teachers. No fees, and no qualifications needed. Codam is an unorthodox coding college designed to address educational inequality, and a shortage of tech professionals. The FT’s Harriet Agnew goes to Amsterdam to meet Codam’s founder and funder, one of the brains behind TomTom, Corinne Vigreux, and discover a new way of learning. Financial Times (ft.com) video above published Jan 15, 2019.

Domain: codam.nl

Tweets by CodamCollege

No teachers. No fees, and no qualifications needed. Codam is an unorthodox coding college designed to address educational inequality, and a shortage of tech professionals. The FT’s Harriet Agnew goes to Amsterdam to meet Codam’s founder and funder, one of the brains behind TomTom, Corinne Vigreux, and discover a new way of learning. Financial Times (ft.com) video above published Jan 15, 2019.

Domain: codam.nl

Tweets by CodamCollege

2019-01-18

The Declining Fortunes of China’s Tech Giants Tencent & Alibaba $BABA

The Declining Fortunes of China’s Tech Giants Tencent & Alibaba $BABA

After years of stellar growth, 2018 saw Tencent and Alibaba $BABA cut back down to size. The FT explains what's behind their fall. Financial Times (ft.com) video above published Jan 15, 2019.

Tencent Holdings Ltd

Alibaba Group Holding Ltd

Chinese exports - looking behind the numbers

The FT's Asia news editor Joe Leahy looks at whether the fall in Chinese exports is down to the trade war with the US or a broader economic slowdown. Financial Times (ft.com) video above published Jan 14, 2019.

Tweets by ftchina

After years of stellar growth, 2018 saw Tencent and Alibaba $BABA cut back down to size. The FT explains what's behind their fall. Financial Times (ft.com) video above published Jan 15, 2019.

Tencent Holdings Ltd

|

| OTCMKTS: TCTZF |

|

| $BABA |

The FT's Asia news editor Joe Leahy looks at whether the fall in Chinese exports is down to the trade war with the US or a broader economic slowdown. Financial Times (ft.com) video above published Jan 14, 2019.

Tweets by ftchina

2019-01-11

Expect Tech To Face a 'Tough Time' in 2019 Says Mark Mobius (video)

Expect tech to face a 'tough time' in 2019: Mark Mobius

Mark Mobius of Mobius Capital Partners (domain: mobiuscapitalpartners.com) also says good news will likely emerge on the U.S.-China trade front, though it's "going to take time." CNBC International TV video above published Jan 8, 2019.

Mark Mobius of Mobius Capital Partners (domain: mobiuscapitalpartners.com) also says good news will likely emerge on the U.S.-China trade front, though it's "going to take time." CNBC International TV video above published Jan 8, 2019.

Tweets by MarkMobiusRealIndia is one of @MarkMobiusReal top investment picks for 2019, but he’s “very much” concerned that Prime Minister Narendra Modi’s economic reform may take a back seat ahead of the general election. @CNBChttps://t.co/kVKoYkyZPm— Mobius Capital Partners (@MobiusCap) January 8, 2019

2018-12-17

Technology & Innovation: What's Next in Consumer Startups?

Technology & Innovation: What's Next in Consumer Startups?

a16z.com video above published Dec 8, 2018, by Andrew Chen, Andreessen Horowitz venture capital firm:

a16z.com video above published Dec 8, 2018, by Andrew Chen, Andreessen Horowitz venture capital firm:

"If you look at consumer adoption curves of major new technologies in the U.S. over the past 100 years, you'll see interesting patterns in both growth and behavior change. Some took longer, some came faster (especially lately, as we reach new heights of software eating the world) -- but one thing is for sure: Technology changes, but people stay the same.

"Even if in some cases new technology requires people to learn new behaviors, the underlying motivations behind those behaviors are the same... not just across people and places, but across history and time. So what does this mean for the next wave of consumer startups?

"As new tech platforms -- such as video, mapping APIs, mobile AR, and more -- hit scale, a the next big wave of consumer products and startups are coming into the ecosystem. But finding and nurturing these startups requires a special combination of understanding the fundamental platform shift; underlying consumer motivations/needs; and key growth insights that enable them to breakout from the fray. Whether they're old "growth hacks" reinvented for the modern era -- from reviews to coupons to chain letters to viral sharing -- or new behaviors only now possible in an offline-to-online world (note the inversion!), such as visible offline experiences that drive further growth online -- the more things change, the more they stay the same."Auto-generated transcript:

👇Thread.— Andrew Chen (@andrewchen) November 1, 2018

Published a new essay: The red flags and magic numbers that investors look for in your startup’s metrics – 80 slide deck included! pic.twitter.com/w6HRD4o22f

An international team of almost 200 psychologists has been trying to repeat a set of previously published experiments from its field, to see if it can get the same results. Despite its best efforts, the project has only succeeded in 14 out of 28 cases. https://t.co/TZuHJYt2Af— Andrew Chen (@andrewchen) December 2, 2018

2018-12-10

Hotel Industry Beware Disruptors Google and Airbnb (video)

Disrupting the Disruptors

L2inc.com video above published Dec 6, 2018: Hotels should fear Google (google.com) and Airbnb (airbnb.com) the way retailers fear Amazon (amazon.com) says Scott Galloway.

Transcript (auto-generated)

00:00 a loser the hotel industry today we're

00:04 gonna look at one of my favorite

00:06 industries no joke I love hotels I

00:08 traveled to hotels not to cities and

00:11 some would describe me as

00:12 high-maintenance I don't think that's

00:14 true my needs are pretty simple all I

00:15 want is a quiet corner suite on the

00:17 second floor two fire exits triple wash

00:19 hypoallergenic sheets no connecting

00:22 doors with prayer rugs facing the

00:24 nearest Chipotle of course a view of the

00:25 sunset over the Sistine Chapel seven boxes

00:28 of starch saran wrap and a babysitter

00:30 from my therapy monkey here we go loser

00:34 Marriott the world's biggest hotel

00:37 company revealed last week hackers stole

00:39 personal data from over 500 million

00:43 that's right 500 million guests Marriott

00:45 has half a billion guests making it one

00:48 of the largest hacks of a corporation

00:51 following Yahoo's premier hack in 2013

00:54 the news hit Marriott stock heart though

00:57 analysts say it shouldn't impact

00:58 financials for the long-term Marriott

01:01 announced it was their Starwood guest

01:03 reservation database that was hacked and

01:06 that hackers had access since 2014 the

01:10 hotel giant acquired Starwood back in

01:12 2016 one of the key selling points of

01:15 Starwood to Marriott our technology and

01:18 our brands oops this is what's called an

01:21 indemnity reserve account when you

01:23 acquire a company and force them to take

01:25 a certain percentage sometimes between

01:26 10 and 18 percent of the consideration

01:29 put it aside in case goes down

01:32 that's a function of things that weren't

01:34 disclosed before the acquisition there's

01:36 going to be a lot of discussion about

01:37 that indemnity account over the next few

01:40 weeks at Marriott so what else could

01:42 keep hoteliers up at night

01:44 simple Airbnb which in my opinion is the

01:47 most valuable private company in the

01:48 world right now

01:49 we just don't know it yet it's grown

01:51 from being an elephant in the room to a

01:53 clear and present danger

01:55 Airbnb site gets over 40 million monthly

01:57 unique visitors more than hotel Giants

01:59 Marriott and Hilton combined and the app

02:02 is the fourth most popular travel app on

02:04 iTunes trailing only Uber Lyft and Yelp

02:08 leaving hotel apps in the dust this year

02:12 Airbnb has launched two a dish

02:14 channel offensive moves to fortify their

02:15 moat one Airbnb Plus which tags their

02:19 best properties and adds hotel like

02:21 amenities and check-ins putting luxury

02:23 hotels squarely in their crosshairs and

02:26 to Airbnb experiences which has over

02:29 5,000 activities that can be booked on

02:31 the app and the new feature is a good

02:33 move from both a usage and search

02:35 perspective Gartner L2 Research found

02:38 that 50% of Airbnb x' unbranded search

02:41 traffic comes from things to do in New

02:43 York City or things to do in Los Angeles

02:45 or whatever city you're traveling to the

02:48 visibility enables Airbnb to compete for

02:50 traffic usually owned by TripAdvisor and

02:52 news media like CNN Traveler and

02:54 Thrillist don't we love it the disruptor

02:56 is not only disrupting traditional

02:58 industry but disrupting the disruptors

03:00 specifically TripAdvisor Airbnb is

03:02 currently valued at thirty 1 billion

03:04 dollars second only to Uber and is

03:07 expected to pursue an IPO in 2019 look

03:10 for Airbnb to be worth more than uber

03:12 why you and I could start a ride hailing

03:15 app with 30 million dollars creating

03:17 supply and demand in one city however

03:19 Airbnb takes advantage of an

03:21 unbelievable mode and that is they have

03:23 global demand we could not start an

03:25 apartment or an outsourced hotel app

03:28 with local supply because we would need

03:31 to create global demand is the majority

03:33 of the people coming into the city are

03:34 from somewhere else the other threats of

03:36 hotels Google Hotels should fear the

03:39 search engine the way retailers fear

03:41 Amazon their first Advantage search

03:43 ownership after years of serving up text

03:46 ads where Hotel searches Google is now

03:48 leveraging search results to drive

03:49 traffic to their own booking experience

03:52 where they again profit from Google

03:55 hotel ads Gartner L2 Research found

03:57 that the Google hotels tool appears 99%

04:01 of the time for search terms including

04:02 Best Hotel in Chicago and luxury hotel

04:05 in Paris in sum Google and all the

04:07 other tech monopolies have a very simple

04:09 playbook hey we can help you hey we are

04:12 you hey we're here to kill you

04:14 Google's second advantage data Google

04:16 sits on massive amounts of user data

04:18 enabling it to pump out free tools that

04:21 help travelers take advantage of travel

04:23 deals this will continue to draw users

04:24 to their platform over online travel

04:27 agencies

04:28 search platforms and hotel brand sites

04:30 hotels beware Google and Airbnb the

04:34 Genghis Khan of your industry look for

04:36 the hotel industry to shed value to

04:39 search engines and to Airbnb we are on

04:42 the precipice of war against a hotel

04:44 industry ...

L2inc.com video above published Dec 6, 2018: Hotels should fear Google (google.com) and Airbnb (airbnb.com) the way retailers fear Amazon (amazon.com) says Scott Galloway.

Transcript (auto-generated)

00:00 a loser the hotel industry today we're

00:04 gonna look at one of my favorite

00:06 industries no joke I love hotels I

00:08 traveled to hotels not to cities and

00:11 some would describe me as

00:12 high-maintenance I don't think that's

00:14 true my needs are pretty simple all I

00:15 want is a quiet corner suite on the

00:17 second floor two fire exits triple wash

00:19 hypoallergenic sheets no connecting

00:22 doors with prayer rugs facing the

00:24 nearest Chipotle of course a view of the

00:25 sunset over the Sistine Chapel seven boxes

00:28 of starch saran wrap and a babysitter

00:30 from my therapy monkey here we go loser

00:34 Marriott the world's biggest hotel

00:37 company revealed last week hackers stole

00:39 personal data from over 500 million

00:43 that's right 500 million guests Marriott

00:45 has half a billion guests making it one

00:48 of the largest hacks of a corporation

00:51 following Yahoo's premier hack in 2013

00:54 the news hit Marriott stock heart though

00:57 analysts say it shouldn't impact

00:58 financials for the long-term Marriott

01:01 announced it was their Starwood guest

01:03 reservation database that was hacked and

01:06 that hackers had access since 2014 the

01:10 hotel giant acquired Starwood back in

01:12 2016 one of the key selling points of

01:15 Starwood to Marriott our technology and

01:18 our brands oops this is what's called an

01:21 indemnity reserve account when you

01:23 acquire a company and force them to take

01:25 a certain percentage sometimes between

01:26 10 and 18 percent of the consideration

01:29 put it aside in case goes down

01:32 that's a function of things that weren't

01:34 disclosed before the acquisition there's

01:36 going to be a lot of discussion about

01:37 that indemnity account over the next few

01:40 weeks at Marriott so what else could

01:42 keep hoteliers up at night

01:44 simple Airbnb which in my opinion is the

01:47 most valuable private company in the

01:48 world right now

01:49 we just don't know it yet it's grown

01:51 from being an elephant in the room to a

01:53 clear and present danger

01:55 Airbnb site gets over 40 million monthly

01:57 unique visitors more than hotel Giants

01:59 Marriott and Hilton combined and the app

02:02 is the fourth most popular travel app on

02:04 iTunes trailing only Uber Lyft and Yelp

02:08 leaving hotel apps in the dust this year

02:12 Airbnb has launched two a dish

02:14 channel offensive moves to fortify their

02:15 moat one Airbnb Plus which tags their

02:19 best properties and adds hotel like

02:21 amenities and check-ins putting luxury

02:23 hotels squarely in their crosshairs and

02:26 to Airbnb experiences which has over

02:29 5,000 activities that can be booked on

02:31 the app and the new feature is a good

02:33 move from both a usage and search

02:35 perspective Gartner L2 Research found

02:38 that 50% of Airbnb x' unbranded search

02:41 traffic comes from things to do in New

02:43 York City or things to do in Los Angeles

02:45 or whatever city you're traveling to the

02:48 visibility enables Airbnb to compete for

02:50 traffic usually owned by TripAdvisor and

02:52 news media like CNN Traveler and

02:54 Thrillist don't we love it the disruptor

02:56 is not only disrupting traditional

02:58 industry but disrupting the disruptors

03:00 specifically TripAdvisor Airbnb is

03:02 currently valued at thirty 1 billion

03:04 dollars second only to Uber and is

03:07 expected to pursue an IPO in 2019 look

03:10 for Airbnb to be worth more than uber

03:12 why you and I could start a ride hailing

03:15 app with 30 million dollars creating

03:17 supply and demand in one city however

03:19 Airbnb takes advantage of an

03:21 unbelievable mode and that is they have

03:23 global demand we could not start an

03:25 apartment or an outsourced hotel app

03:28 with local supply because we would need

03:31 to create global demand is the majority

03:33 of the people coming into the city are

03:34 from somewhere else the other threats of

03:36 hotels Google Hotels should fear the

03:39 search engine the way retailers fear

03:41 Amazon their first Advantage search

03:43 ownership after years of serving up text

03:46 ads where Hotel searches Google is now

03:48 leveraging search results to drive

03:49 traffic to their own booking experience

03:52 where they again profit from Google

03:55 hotel ads Gartner L2 Research found

03:57 that the Google hotels tool appears 99%

04:01 of the time for search terms including

04:02 Best Hotel in Chicago and luxury hotel

04:05 in Paris in sum Google and all the

04:07 other tech monopolies have a very simple

04:09 playbook hey we can help you hey we are

04:12 you hey we're here to kill you

04:14 Google's second advantage data Google

04:16 sits on massive amounts of user data

04:18 enabling it to pump out free tools that

04:21 help travelers take advantage of travel

04:23 deals this will continue to draw users

04:24 to their platform over online travel

04:27 agencies

04:28 search platforms and hotel brand sites

04:30 hotels beware Google and Airbnb the

04:34 Genghis Khan of your industry look for

04:36 the hotel industry to shed value to

04:39 search engines and to Airbnb we are on

04:42 the precipice of war against a hotel

04:44 industry ...

2018-12-03

The 2018 Fortune Investors Roundtable (video)

The 2018 Fortune Investors Roundtable (video)

Analysts preview what the market will bring in 2019. Fortune.com video above published Nov 19, 2018.

Analysts preview what the market will bring in 2019. Fortune.com video above published Nov 19, 2018.

The 5 best tech stocks to buy for 2019 – when Facebook and Google are cheaphttps://t.co/wY8WrK36Dy— FORTUNE (@FortuneMagazine) November 23, 2018

Warren Buffett used to to avoid tech stocks like the plague. Now Apple is his biggest holding. Here’s what changed: https://t.co/erWtdOWhgP— FORTUNE (@FortuneMagazine) November 23, 2018

Meet the CEO of the insurance company growing faster than Apple https://t.co/39Ap9FclIo— FORTUNE (@FortuneMagazine) November 23, 2018

Google’s $1 billion Bay Area buy is the second biggest U.S. real estate deal of 2018. Who’s No. 1? Also Google https://t.co/J0kn7QUcdZ— FORTUNE (@FortuneMagazine) December 2, 2018

Why Salesforce’s chief scientist shut down an AI project that identifies human emotions https://t.co/JjUKB5PubR— FORTUNE (@FortuneMagazine) December 2, 2018

2018-12-01

Tech Review: 1) China's Tech Megacity, 2) Music Industry Renaissance

Tech Review (TR 2018-12-01)--Domain Mondo's weekly review of tech investing news with commentary, analysis and opinion: Features • 1) China's Tech Megacity, 2)Music Industry Renaissance, 3) Investing: US Stocks Surge, Notes: US, China, UK, EU, Italy, Cryptocurrency, 4) ICYMI Tech News: Amazon AWS, Disney, Google, Microsoft, Apple, Nvidia, Personal Tech.

1) China's Tech Megacity

Shenzhen, China, has been dubbed the Silicon Valley of hardware. If you own a smartphone or computer, odds are parts of it came from here. In 30-years the city has grown from a town into a megacity of over 12 million people. Welcome to Shenzhen, the manifestation of China’s economic miracle. Bloomberg.com video published Nov 21, 2018.

The other side of the China story:

2) Music Industry Renaissance

Today’s renaissance in the music industry, driven in large part by the continued success of paid streaming services, is leading to a surge in transaction activity across sectors, explains Aaron Siegel of Goldman Sachs Investment Banking. “Investors have caught on to the growth and recovery and the value of these businesses,” explains Siegel, who attributes the pickup in transaction activity to four factors, such as paid streaming subscription services, an uptick in smart speaker devices and the opening up of new markets, such as China and India. “China today represents a low single-digit percentage of global music revenues, but represents 20 to 30 percent of global film box office and global video game revenues,” Siegel says. “There is enormous upside for the music industry as China continues to grow.” GoldmanSachs.com video above published Nov 12, 2018. Read more here.

3) Investing

The Week: NASDAQ Composite +5.6% | S&P 500 Index +4.9% | DJIA +5.2%

Investing Notes:

US & China: all eyes on Buenos Aires as high-stakes summit between Xi Jinping and Donald Trump could have as many as six aides each joining them at the December 1 dinner after the G20 forum--scmp.com. Trump is surprisingly popular in China--reuters.com.

China cross-border e-commerce shrunk by 16.2% in Q3 2018--chinainternetwatch.com. Also China’s state-owned companies are run for-party, not for-profit--ft.com.

EU & UK: Remaining in the EU would come at a big price--spectator.co.uk. See also Britain has nothing to fear from no deal by Tony Abbott: "It’s pretty hard for Britain’s friends, here in Australia, to make sense of the mess that’s being made of Brexit ...." Editor's note: UK Prime Minister Theresa May has warned lawmakers if they reject her "deal" with the EU, the world’s fifth largest economy may have to leave without an agreement a/k/a "hard Brexit." The House of Commons vote is scheduled for December 11.

EU & Italy: European Commission Begins Budget Battle With Italy--forbes.com. Meanwhile the eurozone recovery continues to falter--ft.com. Eurozone's Days are Numbered--Mike Ingram, chief market strategist at WH Ireland is calling time on the eurozone, saying it is fundamentally “dead” (although it could take decades to disband)--morningstar.co.uk.

Bitcoin Plunges to $3,738; Whole Crypto Scam Melts Down, Hedge Funds Stuck ... $714 billion gone up in smoke--WolfStreet.com.

Virtual currencies have been in a steep downtrend since the beginning of 2018, amid increased regulatory scrutiny and thefts at crypto exchanges. Chief economic adviser at Allianz, Mohamad El-Erian: cryptocurrencies are commodities, not currencies, “They don’t have the intrinsic attributes of a currency. It is not going to replace money.” Though there are now more than 2,000 different cryptocurrencies in circulation, the total value of all coins has crashed--reuters.com.

1) China's Tech Megacity

Shenzhen, China, has been dubbed the Silicon Valley of hardware. If you own a smartphone or computer, odds are parts of it came from here. In 30-years the city has grown from a town into a megacity of over 12 million people. Welcome to Shenzhen, the manifestation of China’s economic miracle. Bloomberg.com video published Nov 21, 2018.

The other side of the China story:

China’s factories lost more momentum in November, according to a key monthly survey of manufacturing firms, with domestic demand again looking bleak despite a recent boost in infrastructure spending.https://t.co/DM8wxS3Ycf— ChinaEconomicReview (@chinaeconreview) November 30, 2018

2) Music Industry Renaissance

Today’s renaissance in the music industry, driven in large part by the continued success of paid streaming services, is leading to a surge in transaction activity across sectors, explains Aaron Siegel of Goldman Sachs Investment Banking. “Investors have caught on to the growth and recovery and the value of these businesses,” explains Siegel, who attributes the pickup in transaction activity to four factors, such as paid streaming subscription services, an uptick in smart speaker devices and the opening up of new markets, such as China and India. “China today represents a low single-digit percentage of global music revenues, but represents 20 to 30 percent of global film box office and global video game revenues,” Siegel says. “There is enormous upside for the music industry as China continues to grow.” GoldmanSachs.com video above published Nov 12, 2018. Read more here.

3) Investing

The Week: NASDAQ Composite +5.6% | S&P 500 Index +4.9% | DJIA +5.2%

U.S. stocks surge on Friday amid G-20 talks and cement best week for S&P 500, NASDAQ in about 7 years--marketwatch.comWall Street's Charging Bull

Investing Notes:

US & China: all eyes on Buenos Aires as high-stakes summit between Xi Jinping and Donald Trump could have as many as six aides each joining them at the December 1 dinner after the G20 forum--scmp.com. Trump is surprisingly popular in China--reuters.com.

China cross-border e-commerce shrunk by 16.2% in Q3 2018--chinainternetwatch.com. Also China’s state-owned companies are run for-party, not for-profit--ft.com.

EU & Italy: European Commission Begins Budget Battle With Italy--forbes.com. Meanwhile the eurozone recovery continues to falter--ft.com. Eurozone's Days are Numbered--Mike Ingram, chief market strategist at WH Ireland is calling time on the eurozone, saying it is fundamentally “dead” (although it could take decades to disband)--morningstar.co.uk.

Bitcoin Plunges to $3,738; Whole Crypto Scam Melts Down, Hedge Funds Stuck ... $714 billion gone up in smoke--WolfStreet.com.

Virtual currencies have been in a steep downtrend since the beginning of 2018, amid increased regulatory scrutiny and thefts at crypto exchanges. Chief economic adviser at Allianz, Mohamad El-Erian: cryptocurrencies are commodities, not currencies, “They don’t have the intrinsic attributes of a currency. It is not going to replace money.” Though there are now more than 2,000 different cryptocurrencies in circulation, the total value of all coins has crashed--reuters.com.

4) ICYMI Tech News:

Amazon AWS introduces its own custom-designed Arm server processor, AWS Graviton Processor, claims 45% lower costs for some workloads--Geekwire.com. A summary of AWS launches, previews, and pre-announcements from AWS re:Invent 2018--aws.amazon.com.

Disney $DIS and Google $GOOG $GOOGL expand strategic relationship: Disney will bring its entire global digital video and display business onto the Google Ad Manager, which will serve as its core ad technology platform--blog.google.

Microsoft $MSFT stock market value, a/k/a market capitalization, "catches up" with Apple $AAPL.

Nvidia $NVDA to provide AI platform for Chinese EV start-ups--reuters.com.

GM: The bottom line is Mary Barra is preparing GM for not only Tesla, but BMW and Mercedes and Uber … She’s doubling-down on electrics and driverless to win in the future, to EXIST in the future.--Lefsetz.com.

Personal Tech: Live on campus or in a city where there is plenty of free wi-fi for internet, texting & voice via apps? You may only need a wireless carrier plan of 30 minutes of talk, 30 texts, or any combination of minutes and texts that add up to 30, for only $3/month. Additional minutes and texts are only $0.10/each. Pay only for what you use (add 4G LTE data when needed, per day or week)--prepaid.t-mobile.com. Editor's note: just remember to turn off your smartphone's cellular network connection when not needed.

-- John Poole, Editor, Domain Mondo

feedback & comments via twitter @DomainMondo

Follow @DomainMondo

DISCLAIMER

Amazon AWS introduces its own custom-designed Arm server processor, AWS Graviton Processor, claims 45% lower costs for some workloads--Geekwire.com. A summary of AWS launches, previews, and pre-announcements from AWS re:Invent 2018--aws.amazon.com.

Disney $DIS and Google $GOOG $GOOGL expand strategic relationship: Disney will bring its entire global digital video and display business onto the Google Ad Manager, which will serve as its core ad technology platform--blog.google.

Microsoft $MSFT stock market value, a/k/a market capitalization, "catches up" with Apple $AAPL.

Nvidia $NVDA to provide AI platform for Chinese EV start-ups--reuters.com.

GM: The bottom line is Mary Barra is preparing GM for not only Tesla, but BMW and Mercedes and Uber … She’s doubling-down on electrics and driverless to win in the future, to EXIST in the future.--Lefsetz.com.

Personal Tech: Live on campus or in a city where there is plenty of free wi-fi for internet, texting & voice via apps? You may only need a wireless carrier plan of 30 minutes of talk, 30 texts, or any combination of minutes and texts that add up to 30, for only $3/month. Additional minutes and texts are only $0.10/each. Pay only for what you use (add 4G LTE data when needed, per day or week)--prepaid.t-mobile.com. Editor's note: just remember to turn off your smartphone's cellular network connection when not needed.

-- John Poole, Editor, Domain Mondo

feedback & comments via twitter @DomainMondo

Follow @DomainMondo

DISCLAIMER

2018-11-30

Digital Winner Microsoft $MSFT, Digital Loser Facebook $FB? (video)

2018's Most Spineless Board

L2inc.com video above published Nov 29, 2018--Scott Galloway's digital winners and losers--it's time for Facebook's Board of Directors to stand on their feet.

00:04 Microsoft dethroned Apple even if just

00:07 for a minute as the most valuable firm

00:10 in the US boasting a market

00:11 capitalization north of 800 billion

00:15 dollars to be fair it's not that

00:16 Microsoft passed Apple but that Apple

00:19 fell below Microsoft shedding a quarter

00:21 of a trillion dollars in value as

00:23 analysts wonder if we've reached peak

00:25 iPhone what explains Microsoft success

00:28 or more specifically their staying power

00:31 two things first

00:32 diversity Microsoft maintains a diverse

00:35 revenue stream from software hardware

00:36 and cloud services meanwhile Alphabet

00:40 and Facebook are mostly ad dependent

00:42 Apple is a hardware firm and Amazon

00:44 relies mostly on product sales to

00:47 recurring revenue successful

00:49 organizations have convinced customers

00:51 to enter into a monogamous relationship

00:53 via recurring revenue streams think

00:57 Netflix Spotify and Amazon run what

01:00 Amazon Prime has done with the consumer

01:02 market Microsoft has done with the

01:04 business market visa vie their office

01:06 offering it's much easier to plan a

01:08 business against recurring revenue and

01:10 the market loves it a Loser the Facebook

01:14 Board of Directors our 2018 award for

01:17 most spineless and damaging Board of

01:19 Directors what is the role of a Board of

01:21 Directors care and duty specifically

01:24 serve as fiduciaries for stake holders

01:26 that includes teens that includes the

01:29 Commonwealth and of course shareholders

01:31 who have seen the value of their shares

01:33 shed a third of their value because of

01:36 irresponsible reckless negligent

01:39 behavior on the part of the CEO and the

01:42 CEO oh so at the end of the day what is

01:44 a board supposed to do they decide if

01:46 and when the company gets sold and to

01:48 hire and fire the CEO what has the board

01:51 done here nothing what should they do

01:54 first they should fire Sheryl Sandberg

01:57 the problem with a two-class shareholder

01:59 structure and the reason the SEC should

02:02 revisit the concept of banning all to

02:05 class companies or perhaps making it

02:08 such that when a company punched through

02:10 a hundred billion in market cap it

02:11 reverts to one class of stock

02:13 it has a ripple effect of unintended

02:16 consequences in the unintended

02:17 consequence here is that their COO that

02:20 should have been fired a year ago is

02:22 still here because quite frankly the

02:24 board does not want to be the board that

02:26 fires the woman in a sea of men in big

02:29 tech and that's a legitimate excuse

02:31 however she has made a billion dollars

02:35 and she will move on and do just fine

02:37 every day executives are fired for a

02:39 fraction of the infractions of Miss

02:42 Sandberg and the Zuck at the end of the

02:45 day the person ultimately responsible

02:47 for all of this reckless behavior that

02:49 this company is Mark Zuckerberg and he

02:52 should be removed from the CEO role he

02:55 should likely maintain his chairmanship

02:56 his DNA and programming genius is key to

03:00 retention of the value of this firm he

03:02 deserves to stick around he owned 16% of

03:05 the company however he can be fired and

03:08 this is how he could fight back he

03:11 controls 60% of the voting shares so if

03:13 he is removed from the CEO role it is

03:15 technically feasible that the next day

03:17 he removes the entire board what would

03:20 actually happen play this out the day

03:23 after he is removed from the CEO role he

03:26 fires his entire board that would be

03:29 utter chaos a five-car alarm alerting

03:33 legislators shareholder rights lawsuits

03:36 and governments globally we have to ask

03:38 would in fact the Zuck burn his castle to

03:42 save it the board should not be asking

03:44 this the board should be asking what is

03:47 the right thing to do as Emiliano Zapata

03:49 famously said it is better to die on

03:52 your feet than to live on your knees it

03:54 is time for the Board of Directors at

03:56 Facebook to stand on their feet ....

L2inc.com video above published Nov 29, 2018--Scott Galloway's digital winners and losers--it's time for Facebook's Board of Directors to stand on their feet.

|

| $MSFT |

|

| $FB |

|

| $AAPL |

|

| $AMZN |

Auto-generated transcript:

00:00 A Winner: Microsoft earlier this week00:04 Microsoft dethroned Apple even if just

00:07 for a minute as the most valuable firm

00:10 in the US boasting a market

00:11 capitalization north of 800 billion

00:15 dollars to be fair it's not that

00:16 Microsoft passed Apple but that Apple

00:19 fell below Microsoft shedding a quarter

00:21 of a trillion dollars in value as

00:23 analysts wonder if we've reached peak

00:25 iPhone what explains Microsoft success

00:28 or more specifically their staying power

00:31 two things first

00:32 diversity Microsoft maintains a diverse

00:35 revenue stream from software hardware

00:36 and cloud services meanwhile Alphabet

00:40 and Facebook are mostly ad dependent

00:42 Apple is a hardware firm and Amazon

00:44 relies mostly on product sales to

00:47 recurring revenue successful

00:49 organizations have convinced customers

00:51 to enter into a monogamous relationship

00:53 via recurring revenue streams think

00:57 Netflix Spotify and Amazon run what

01:00 Amazon Prime has done with the consumer

01:02 market Microsoft has done with the

01:04 business market visa vie their office

01:06 offering it's much easier to plan a

01:08 business against recurring revenue and

01:10 the market loves it a Loser the Facebook

01:14 Board of Directors our 2018 award for

01:17 most spineless and damaging Board of

01:19 Directors what is the role of a Board of

01:21 Directors care and duty specifically

01:24 serve as fiduciaries for stake holders

01:26 that includes teens that includes the

01:29 Commonwealth and of course shareholders

01:31 who have seen the value of their shares

01:33 shed a third of their value because of

01:36 irresponsible reckless negligent

01:39 behavior on the part of the CEO and the

01:42 CEO oh so at the end of the day what is

01:44 a board supposed to do they decide if

01:46 and when the company gets sold and to

01:48 hire and fire the CEO what has the board

01:51 done here nothing what should they do

01:54 first they should fire Sheryl Sandberg

01:57 the problem with a two-class shareholder

01:59 structure and the reason the SEC should

02:02 revisit the concept of banning all to

02:05 class companies or perhaps making it

02:08 such that when a company punched through

02:10 a hundred billion in market cap it

02:11 reverts to one class of stock

02:13 it has a ripple effect of unintended

02:16 consequences in the unintended

02:17 consequence here is that their COO that

02:20 should have been fired a year ago is

02:22 still here because quite frankly the

02:24 board does not want to be the board that

02:26 fires the woman in a sea of men in big

02:29 tech and that's a legitimate excuse

02:31 however she has made a billion dollars

02:35 and she will move on and do just fine

02:37 every day executives are fired for a

02:39 fraction of the infractions of Miss

02:42 Sandberg and the Zuck at the end of the

02:45 day the person ultimately responsible

02:47 for all of this reckless behavior that

02:49 this company is Mark Zuckerberg and he

02:52 should be removed from the CEO role he

02:55 should likely maintain his chairmanship

02:56 his DNA and programming genius is key to

03:00 retention of the value of this firm he

03:02 deserves to stick around he owned 16% of

03:05 the company however he can be fired and

03:08 this is how he could fight back he

03:11 controls 60% of the voting shares so if

03:13 he is removed from the CEO role it is

03:15 technically feasible that the next day

03:17 he removes the entire board what would

03:20 actually happen play this out the day

03:23 after he is removed from the CEO role he

03:26 fires his entire board that would be

03:29 utter chaos a five-car alarm alerting

03:33 legislators shareholder rights lawsuits

03:36 and governments globally we have to ask

03:38 would in fact the Zuck burn his castle to

03:42 save it the board should not be asking

03:44 this the board should be asking what is

03:47 the right thing to do as Emiliano Zapata

03:49 famously said it is better to die on

03:52 your feet than to live on your knees it

03:54 is time for the Board of Directors at

03:56 Facebook to stand on their feet ....

2018-11-21

Dropbox CEO Drew Houston and the Evolution of a Tech Entrepreneur

Drew Houston: Dropbox and the Evolution of a Tech Entrepreneur

Goldman Sachs video above published Nov 12, 2018: In this episode of Talks at GS, filmed at Goldman Sachs’ Builders + Innovators Summit, Dropbox (dropbox.com) co-founder and CEO Drew Houston discusses what he has learned as he continues to grow the cloud computing company into one of the biggest disruptors in Silicon Valley.

NASDAQ: DBX

Tweets by Dropbox

Goldman Sachs video above published Nov 12, 2018: In this episode of Talks at GS, filmed at Goldman Sachs’ Builders + Innovators Summit, Dropbox (dropbox.com) co-founder and CEO Drew Houston discusses what he has learned as he continues to grow the cloud computing company into one of the biggest disruptors in Silicon Valley.

NASDAQ: DBX

|

| $DBX |

2018-11-10

Tech Review: 1) The Google Monopoly; 2) Credit Card Chips & Fraud

Tech Review (TR 2018-11-10)--Domain Mondo's weekly review of tech investing news with commentary, analysis and opinion: Features • 1) The Google Monopoly, 2)Credit Card Chips & Fraud, 3) Investing: The Week, Investing Notes, 4)ICYMI Tech News: Amazon, Apple, Alibaba, Crypto.

1) The Google Monopoly

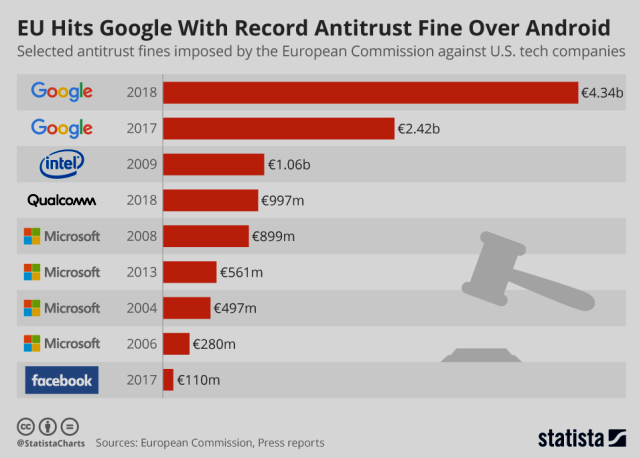

CNBC International video above published Nov 1, 2018: Google has been fined record-breaking amounts by the European Commission for violating antitrust rules. Is Google a monopoly that needs to be broken up? CNBC’s Elizabeth Schulze explains from Brussels.

See also: The New York Times is digitizing its 5-7M photo archive using Google AI to recognize text describing the photos and will use Google's storage services--cnet.com.

Charts above courtesy of statista.com.

2) Credit Card Chips & Fraud

Fortune.com video above published Nov 5, 2018: Credit card chips fail to end fraud according to a new report.

3) Investing

The Week: NASDAQ Composite +0.7% | S&P 500 Index +2.1% | DJIA +2.8%

For the year:

Investing Notes:

4) ICYMI Tech News:

-- John Poole, Editor, Domain Mondo

feedback & comments via twitter @DomainMondo

Follow @DomainMondo

DISCLAIMER

1) The Google Monopoly

CNBC International video above published Nov 1, 2018: Google has been fined record-breaking amounts by the European Commission for violating antitrust rules. Is Google a monopoly that needs to be broken up? CNBC’s Elizabeth Schulze explains from Brussels.

See also: The New York Times is digitizing its 5-7M photo archive using Google AI to recognize text describing the photos and will use Google's storage services--cnet.com.

Charts above courtesy of statista.com.

2) Credit Card Chips & Fraud

Fortune.com video above published Nov 5, 2018: Credit card chips fail to end fraud according to a new report.

3) Investing

The Week: NASDAQ Composite +0.7% | S&P 500 Index +2.1% | DJIA +2.8%

For the year:

- The NASDAQ Composite is up 503.51 points, or 7.3%.

- The S&P 500 is up 107.40 points, or 4%.

- The DJIA is up 1,270.08 points, or 5.1%.

Investing Notes:

- Apple, Microsoft, Amazon, Google and Facebook have a combined market capitalization of $3.7 trillion, equal to Germany’s gross domestic product (GDP) last year--Tim Berners-Lee says tech giants may have to be split up--reuters.com.

- China: "Chinese President Xi Jinping and his team did not get the midterm [Blue] wave they were hoping for. The Chinese side may once have had a fantasy that the midterm elections would force President Trump to back down on tariffs but there is little to nothing in the results that would lead Trump to change his approach to prosecuting his trade war with China, and in fact he may see reasons to redouble his efforts."-- Bill Bishop of Sinocism | Axios.com. Trump and Xi will discuss trade issues when the two meet for dinner on the sidelines of the G20 leaders’ summit at the end of November in Buenos Aires, Argentina--reuters.com

- Buffett's Berkshire doubles profit, repurchases $900 million stock in third quarter--reuters.com.

- Move over Netflix: Disney says its new streaming service will be called Disney+ and will launch in the US in late 2019--cnbc.com.

- Goldman Sachs ensnarled in vast 1MDB fraud scandal--NYTimes.com.

- Hilarious How Wall-Street Crybabies Whine about the Fed’s QE Unwind after a Decade of “Wealth Effect”--Their “Everything Bubble” is being pricked “gradually,” and they don’t like it.--WolfStreet.com.

4) ICYMI Tech News:

- Amazon $AMZN is spending billions to win Indian shoppers--bloomberg.com. Also: Amazon plans to split HQ2 evenly between two cities--wsj.com; Amazon.com Inc. said effective Nov 5, it would offer free shipping with no purchase minimum for the first time, this Christmas shopping season--reuters.com.

- Apple $AAPL: India iPhone sales to fall for first time in four years: researcher--reuters.com. Amazon signs a deal with Apple--cnet.com--will start selling its latest devices, except the HomePod, in the US, UK, France, Germany, Italy, Spain, Japan, and India.

- Alibaba $BABA cuts sales forecast on economic uncertainty, trade fears--reuters.com. Alibaba Singles Day Nov 11, a major shopping extravaganza in China--cnbc.com video.

- China's leading self-driving startups are betting on leveraging talent and capital in Silicon Valley--axios.com.

- Tech CEOs Are in Love With Their Principal Doomsayer--The futurist philosopher Yuval Noah Harari thinks Silicon Valley is an engine of dystopian ruin. So why do the digital elite adore him so?--NYTimes.com.

- Crypto: Policing the Wild West of Cryptocurrency--morganlewis.com. See also Bitcoin: New Asset Class or Pyramid Scheme? | cfainstitute.org.

- Personal Tech: a. New MacBook Air threatens both MacBook and MacBook Pro with function keys--appleinsider.com; b. Files by Google: Clean up space on your phone--Google’s Files Go hits 30 million users and is getting a new name--theverge.com.

-- John Poole, Editor, Domain Mondo

feedback & comments via twitter @DomainMondo

Follow @DomainMondo

DISCLAIMER

Subscribe to:

Posts (Atom)

Domain Mondo archive

-

▼

2019

(185)

-

▼

July

(7)

- News Review Postscript

- Tech Review 1) Why Jony Ive Chose To Leave Apple, ...

- Starbucks 15-Year Journey to 100% Ethically Source...

- The English Language & Americanisms (video)

- Digital Detox | Surviving Without Tech for Three D...

- Android or iOS, Why Smartphones Aren't Exciting An...

- David Rosenberg on the U.S. Economy, Recession, U....

-

▼

July

(7)